TL;DR

- VAT (Value Added Tax): You add it to your invoice. Your client pays more. You collect it and remit to the government.

- WHT (Withholding Tax): Your client deducts it from your payment. You receive less. It counts as a prepayment of your income tax.

- Most creators and freelancers will deal with WHT more often than VAT.

- The rates depend on what type of work you do and who your client is.

The confusion is real

If you've ever sent an invoice to a Nigerian company and received less than you billed, you've experienced WHT. If you've ever wondered why some invoices show "VAT" as an extra charge, that's a different tax entirely.

These two taxes work in opposite directions, but many creators mix them up. Let's fix that.

VAT: You charge extra, client pays more

Value Added Tax (VAT) is a consumption tax. When you sell goods or services, you add VAT on top of your price. The client pays your fee plus the VAT amount.

How VAT works in practice

You're a graphic designer. You charge ₦500,000 for a branding project.

| Item | Amount | | ------------------- | ------------ | | Your design fee | ₦500,000 | | VAT (7.5%) | ₦37,500 | | Client pays you | ₦537,500 |

You receive ₦537,500 from the client. But ₦37,500 of that isn't yours to keep. You collected it on behalf of the government and must remit it to the Nigeria Revenue Service (NRS).

Your actual earnings: ₦500,000.

The current VAT rate in Nigeria

7.5% is the standard VAT rate in Nigeria as of 2025.

Who needs to charge VAT?

You're required to register for VAT and charge it on your invoices if:

- Your annual turnover exceeds ₦25 million, OR

- You supply VAT-able goods or services (most services are VAT-able)

If you're below the threshold, VAT registration is optional. But many businesses still register because:

- It looks more professional

- Some corporate clients prefer working with VAT-registered vendors

- You can reclaim VAT on business purchases (input VAT)

What's exempt from VAT?

Some things don't attract VAT:

- Basic food items

- Medical and pharmaceutical products

- Educational materials and services

- Baby products

- Exported services (services provided to clients outside Nigeria)

That last one is important for remote workers. If your client is a company based in the US or UK, and you're providing services to them from Nigeria, that's technically an export. Exported services are zero-rated for VAT purposes.

WHT: Client deducts, you receive less

Withholding Tax (WHT) works completely differently. It's not an extra charge. It's a deduction.

When a company pays you for services, they're required by law to withhold a percentage of your payment and remit it directly to the tax authority. You receive less than your invoice amount.

How WHT works in practice

You're a video editor. You invoice a Nigerian media company ₦500,000 for editing work.

| Item | Amount | | --------------------------- | ------------ | | Your editing fee | ₦500,000 | | WHT (5%) withheld by client | -₦25,000 | | You receive | ₦475,000 |

The client keeps ₦25,000 and pays it to the NRS on your behalf. You get ₦475,000.

But here's the key part: that ₦25,000 is not lost money. It's a prepayment of your income tax. When you file your annual tax return, you can use it as a credit against what you owe.

Think of it like this: your client is paying part of your tax bill for you, in advance.

WHT rates by service type

The WHT rate depends on what kind of work you do:

| Service Type | Rate (Companies) | Rate (Individuals) | | ------------------------------------------------------- | ---------------- | ------------------ | | Professional services (consulting, design, development) | 10% | 5% | | Technical services | 10% | 5% | | Management services | 10% | 5% | | Contracts and agency | 5% | 5% | | Construction | 5% | 5% | | Rent | 10% | 10% | | Royalties | 10% | 10% | | Directors' fees | 10% | 10% | | Dividends | 10% | 10% | | Interest | 10% | 10% |

For most creators and freelancers: If you're an individual (not a registered company) providing professional services like design, development, writing, or consulting, the WHT rate is 5%.

If you've registered a company (LLC or Ltd), the rate jumps to 10%.

The TIN penalty

If you don't have a Tax Identification Number (TIN), clients may withhold at double the normal rate. That means 10% instead of 5% for individuals, or 20% instead of 10% for companies.

This is why getting your TIN matters. Register at taxid.nrs.gov.ng.

Who withholds WHT?

Not everyone is required to withhold. WHT is typically withheld by:

- Government agencies and ministries

- Companies (incorporated businesses)

- Organizations above certain turnover thresholds

If you're invoicing an individual or a small unregistered business, they probably won't withhold WHT. But any corporate client will.

VAT and WHT: Can both apply to the same invoice?

Yes. An invoice can have both VAT added and WHT deducted. They're separate taxes with different purposes.

Example: Both taxes on one invoice

You're a consultant. You invoice a corporate client ₦1,000,000 for a strategy project.

| Item | Amount | | ------------------------ | -------------- | | Your consulting fee | ₦1,000,000 | | VAT (7.5%) added | +₦75,000 | | Invoice total | ₦1,075,000 | | WHT (5%) withheld on fee | -₦50,000 | | You receive | ₦1,025,000 |

The client pays ₦1,075,000 total. Of that:

- ₦50,000 goes to NRS as WHT (prepayment of your income tax)

- ₦75,000 goes to NRS as VAT (which you collected and must remit)

- ₦950,000 is your actual take-home before remitting VAT

Note: WHT is calculated on your fee (₦1,000,000), not on the VAT-inclusive total.

Which matters more for creators?

For most Nigerian creators and remote workers:

WHT is the one you'll deal with most often.

Here's why:

- VAT registration threshold: If you earn under ₦25M/year, VAT registration is optional

- Export exemption: If your clients are mostly international (US, UK, EU companies), your services may be zero-rated for VAT

- Corporate clients withhold automatically: Any Nigerian company paying you will withhold WHT whether you like it or not

The practical reality: you'll see WHT deductions on payments from Nigerian corporate clients. You may or may not need to worry about VAT depending on your revenue and client mix.

For remote workers with international clients

If you work for companies based outside Nigeria (remote work for US/UK/EU companies), your situation is simpler:

- VAT: Likely zero-rated (exported services)

- WHT: Foreign companies don't withhold Nigerian WHT

You'll receive your full invoice amount. But you're still responsible for paying income tax on your earnings when you file your annual return.

The advantage: no deductions at source. The responsibility: you need to set aside money for taxes yourself.

For creators with Nigerian corporate clients

If you do work for Nigerian companies (agencies, media houses, banks, telecoms):

- VAT: You may need to charge 7.5% on top of your fee (if registered)

- WHT: They will deduct 5% (individual) or 10% (company) from your payment

Make sure to:

- Include your TIN on every invoice (to avoid double WHT rates)

- Request a WHT credit note or certificate from the client (proof of withholding for your tax return)

- Track all WHT deductions throughout the year (you'll need this to claim credits)

Common mistakes to avoid

Mistake 1: Confusing VAT and WHT

VAT is added to your price. WHT is subtracted from your payment. They're not interchangeable.

Mistake 2: Not having a TIN

Without a TIN, you may face double WHT rates. That's money you're losing unnecessarily.

Mistake 3: Not tracking WHT deductions

Every WHT deduction is a tax credit. If you don't track them and claim them on your annual return, you're effectively paying tax twice on the same income.

Mistake 4: Charging VAT on exported services

If your client is based outside Nigeria, you generally shouldn't charge VAT. Exported services are zero-rated.

Mistake 5: Forgetting to remit collected VAT

If you charge VAT, you must remit it to the NRS. Keeping it is tax evasion.

Quick reference

| Question | VAT | WHT | | -------------------- | ------------------------------------- | -------------------------------- | | Who pays? | Client pays extra | Client deducts from your payment | | Direction | Added to invoice | Subtracted from payment | | Rate | 7.5% | 5-10% depending on service type | | You receive | More than your fee (temporarily) | Less than your fee | | What happens to it? | You remit to NRS | Client remits to NRS | | Can you get it back? | Input VAT credits (if VAT-registered) | Credit against income tax |

Keeping track of it all

Managing VAT and WHT manually is tedious:

- Calculating the right percentages

- Ensuring TINs are on every invoice

- Tracking which clients withheld what

- Keeping receipts and credit notes

- Reconciling everything at tax time

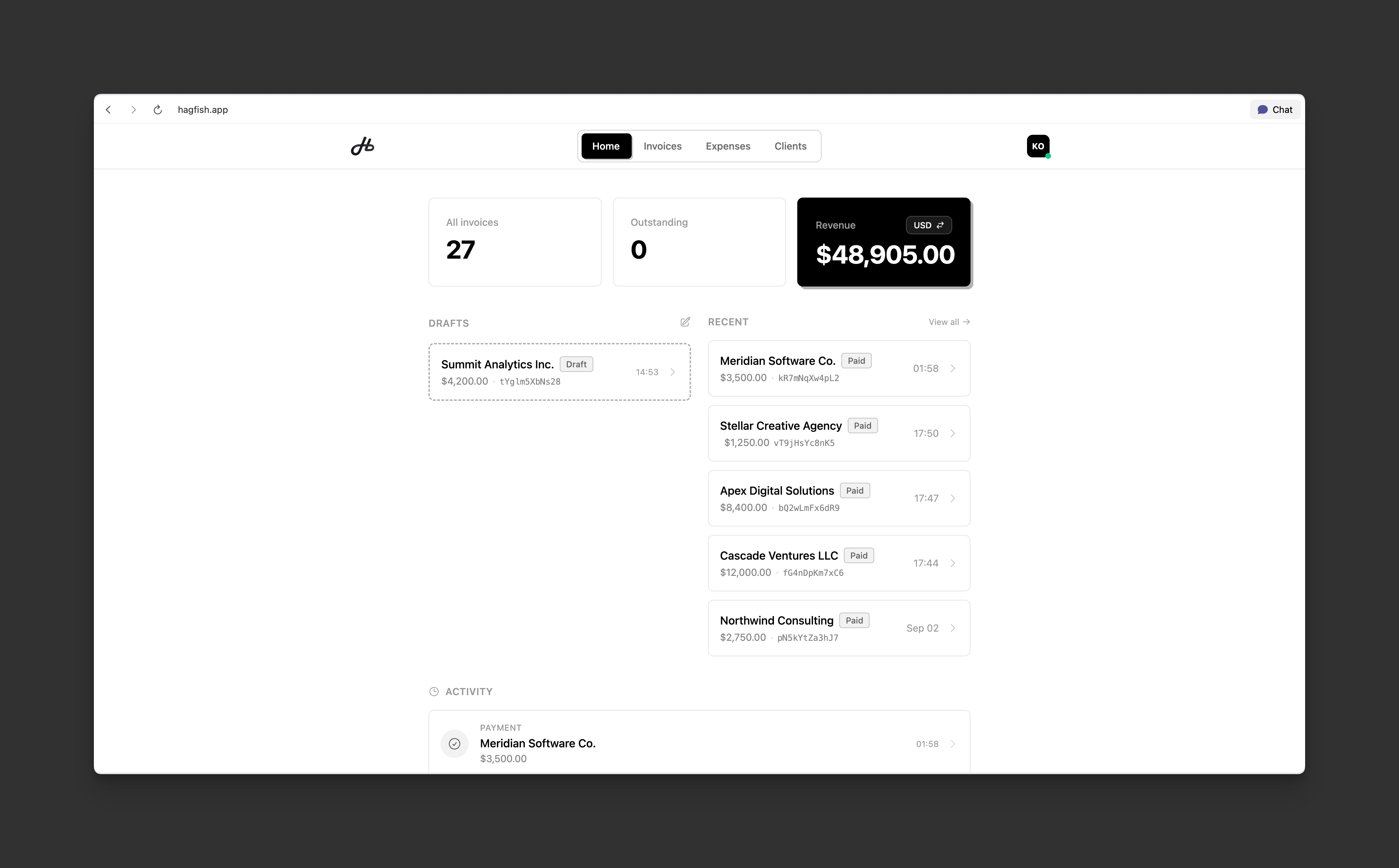

This is exactly why we built Hagfish. Every invoice you create automatically:

- Calculates VAT or WHT based on your selection

- Includes your TIN and your client's TIN

- Records tax amounts for easy year-end reporting

- Stores everything in one searchable place

You focus on the work. Hagfish handles the tax math.

If you're a creator or remote worker who wants to stay compliant without the spreadsheet headaches, give Hagfish a try.

Related reading: