TL;DR;

- Nigeria’s Tax Act 2025 brings major changes for freelancers, digital creators, and businesses.

- Income from digital platforms is now fully taxable, new tax bodies have replaced or restructured the role of FIRS, reporting is stricter, and enforcement will be tougher.

- But if you stay organized (keeping records of invoices, Withholding Tax (WHT), and Value Added Tax (VAT)), compliance doesn't have to be overwhelming.

Introduction

Taxes may not be the most exciting part of building your business or earning as a remote creator, but they’re unavoidable. With the introduction of the Nigeria Tax Act 2025, the rules of the game have changed in ways that directly affect creators, freelancers, and small businesses.

If you earn income online, work with international clients, run a small studio, or manage a remote team, this reform matters to you. Let’s break down what’s new, why it matters, and how you can stay compliant without losing focus on your actual work.

Key changes in the Tax Act 2025

The Nigeria Tax Act 2025 isn't just a routine amendment. It's a major restructuring of how taxes are defined, collected, and enforced in Nigeria. For creators, freelancers, and businesses, this means clearer rules but also tighter oversight.

Below are the most important changes you should know about, and how they could affect your day-to-day work.

Digital economy recognition

One of the most significant shifts in the Tax Act 2025 is the formal recognition of the digital economy as a taxable space. Until now, income from online work was often overlooked, misunderstood, or inconsistently enforced. The new law closes that gap.

Here’s what it means in practice:

- Content creators & influencers: Revenue from YouTube, TikTok, Instagram, podcasts, and streaming platforms now falls squarely within taxable income, regardless of whether you're paid directly (ads, sponsorships) or indirectly (brand deals, affiliate links).

- Course creators & educators: Online courses, digital products, and training programs (Udemy, Gumroad, Teachable, or even self-hosted platforms) are covered.

- SaaS & subscription businesses: If you build or sell software, apps, or subscription services, your recurring income is taxable, even if many customers are international.

- Freelancers & remote workers: Payments received from global platforms like Upwork, Fiverr, Toptal, or direct foreign clients must be declared.

- Marketplaces & e-commerce sellers: Income from selling digital goods (templates, plugins, music, ebooks) or physical goods via online marketplaces is also included.

💡 Cross-border payments are not exempt. Even if clients or platforms pay you from outside Nigeria, the Act clarifies that income is taxable once earned by a Nigerian resident or business.

Why this matters:

- The "grey area" is gone. What used to be a matter of interpretation is now codified into law.

- Platforms and payment processors may be required to share transaction data with the new Nigeria Revenue Service (NRS). That means under-reporting or ignoring online income is far riskier.

- For creators and small businesses, this isn't just about compliance. It's about planning. Setting aside tax portions from online revenue is now essential to avoid surprise liabilities.

New tax administration bodies and who actually enforces the law

The 2025 reforms don't just rewrite tax rules. They also restructure who enforces them. Important new bodies and statutes introduced include:

Nigeria Revenue Service (NRS)

The Nigeria Revenue Service (NRS) is the headline reform in the 2025 Act. It replaces and consolidates many of the functions of the Federal Inland Revenue Service (FIRS) into a single, more powerful body.

Unlike the FIRS, which often operated with fragmented enforcement and overlapping roles with state agencies, the NRS is designed to be a centralized, digital-first tax authority. Its mandate covers:

- Collection & enforcement of federal taxes: income tax, VAT, company tax, and levies previously overseen by FIRS.

- Expanded audit powers: the NRS can request transaction histories from banks, payment processors, and digital platforms to cross-check reported income.

- National taxpayer registry: a unified database of tax IDs for individuals and businesses, intended to reduce duplication and make compliance more traceable.

- Digital filing & reporting: expect NRS systems to integrate online filing portals, electronic invoices, and machine-readable tax returns.

Why this matters for you

- If you’re registered with FIRS, you’ll need to ensure your details are migrated correctly to the NRS system.

- The NRS will likely work more closely with fintech companies (like Paystack, Flutterwave, or even global platforms such as Stripe and PayPal) to capture income that might previously have been invisible.

- For creators and freelancers, this means income from YouTube, Upwork, or Patreon can be flagged automatically if payments hit your Nigerian bank account.

- Businesses should prepare for more standardized (but also more rigorously enforced) reporting obligations.

The NRS represents a shift from a paper-heavy, fragmented system to a centralized, data-driven authority. While compliance will become easier in some ways, it also means it will be much harder to “fly under the radar.”

Nigeria Tax Administration Act (NTAA)

The Nigeria Tax Administration Act (NTAA) serves as the administrative backbone of the 2025 reform. While the NRS is the body that enforces tax laws, the NTAA provides the rules of the game, setting out how registration, filing, compliance, and disputes must be handled across all taxes.

Key areas covered by the NTAA include:

- Registration & taxpayer identification: clearer processes for registering individuals, freelancers, and businesses. Everyone is expected to have a unique tax identification number (TIN) under a unified system.

- Filing requirements: standard timelines and formats for tax returns, whether you're declaring income tax, VAT, or withholding tax.

- Penalties & enforcement: uniform rules for late filing, underpayment, or non-compliance, removing the inconsistencies that previously existed between different laws.

- Taxpayer rights: codifies protections such as the right to clear communication, access to information on assessments, and channels for appeal.

- Audit procedures: outlines how audits will be triggered, conducted, and concluded, aiming for more transparency and consistency.

- Dispute resolution: creates structured processes for challenging assessments or penalties, reducing the ad-hoc nature of past disputes.

Why this matters for you:

- If you’re a creator or freelancer, expect a more formalized registration process and obligations to keep your TIN active and updated.

- Filing taxes may feel more standardized, but the NTAA also introduces stricter penalties for missing deadlines or submitting incomplete information.

- Businesses will need to align internal record-keeping with NTAA expectations, ensuring invoices, receipts, and WHT records are properly formatted.

- The recognition of taxpayer rights is also significant: it gives individuals and small businesses more confidence that disputes won’t be arbitrary.

The NTAA modernizes tax administration by making it more digital, consistent, and enforceable. For compliant taxpayers, it could reduce confusion. For those who try to cut corners, it means less room to hide.

Get your Tax Identification Number (TIN) now

Under the Tax Act 2025, operating a business without a valid Tax Identification Number (TIN) can attract fines of up to ₦5,000,000. This isn't a theoretical risk. Enforcement is actively ramping up.

The good news: getting your TIN is now easier than ever. The Nigeria Revenue Service has launched a streamlined online portal where you can register using:

- Your NIN (National Identification Number): for individuals and sole proprietors

- Your RC Number: for registered companies

👉 Register for your TIN here: taxid.nrs.gov.ng

The process takes just a few minutes online. Once registered, your TIN becomes your universal tax identifier across all federal taxes: income tax, VAT, WHT, and company tax.

Why you shouldn't delay:

- Avoid massive fines: ₦5M is a significant penalty that could cripple a small business or wipe out a freelancer's savings.

- Required for invoicing: Many corporate clients now require your TIN on invoices before they can process payments or claim deductions.

- Bank account scrutiny: Financial institutions are increasingly required to verify TIN status, which could affect your ability to receive business payments.

- No TIN = double WHT: Clients withholding tax from your payments may apply higher rates (sometimes doubled) if you can't provide a valid TIN.

If you've been putting this off, now is the time. A few minutes of registration today could save you millions in penalties tomorrow.

Joint Revenue Board (or Joint Revenue Body)

The Joint Revenue Board (JRB) iIts purpose is to harmonize and coordinate revenue administration and tax practices across federal, state, and local government levels.

Key functions of the JRB

The JRB replaced the previous Joint Tax Board (JTB) as part of Nigeria's 2025 tax reforms, with the following primary responsibilities:

- Harmonize taxation: Promote consistency and uniformity in tax policies, rates, and collection methods across all tiers of government.

- Coordinate revenue administration: Streamline the processes of revenue collection to increase efficiency and eliminate conflicts and overlaps between different tax authorities.

- Manage taxpayer data: Maintain and integrate a unified national database of Taxpayer Identification Numbers (TINs). Resolve disputes: Mediate and settle disputes that arise between tax authorities, such as those concerning the residency of taxpayers.

- Promote fiscal policy: Advise the federal and state governments on new tax policies and provide periodic analysis on the tax framework.

State Revenue Authorities / Local Agencies

While the NRS centralizes many federal functions, state and local revenue bodies remain important for certain levies and taxes. The reform pushes for stronger coordination so states can’t unknowingly create conflicting obligations.

Practical effect: tax enforcement will be more centralized, more coordinated, and more data-driven. Expect the new authorities to pursue better information sharing with banks, payment processors, and fintech platforms.

Simplified filing (but stricter reporting)

The Act pushes for digital filing portals, standardized VAT/WHT reporting, and machine-readable returns. The paperwork burden may be lower over time, but the data you must provide will be more granular.

Stronger enforcement powers

The new authorities have clearer powers to demand information, run audits, issue assessments, and apply penalties. There’s also an emphasis on cross-platform data sharing (banks, Paystack/Flutterwave, international payment processors) to detect under-reporting.

Incentives for compliance

To encourage voluntary compliance, the Act includes incentives for early registration and filing, such as reduced penalties, credits for timely adopters, or fast-track registration for businesses using approved platforms.

What this means for you

Whether you’re a solo freelancer, a growing studio, or a remote team, here’s what you need to know:

- You may need to register with the new Nigeria Revenue Service (NRS) or ensure existing registration transfers cleanly from FIRS.

- Expect more audits and requests for transaction data, so keep invoices, contracts, and WHT evidence neatly stored.

- Payment platforms and banks may share more of your transaction data with tax authorities — having reconciled records will save you stress.

- Harmonization between federal and state bodies should reduce contradictory demands, but you’ll still need to monitor state-level obligations.

- Staying compliant early could save you money in penalties and position you for incentives.

Why tracking expenses can lower your tax bill

Here's something many creators don't realize: you're only taxed on your profit, not your revenue. That means every legitimate business expense you track reduces the amount you owe in taxes.

Let's say you earned ₦5,000,000 this year from YouTube ads and sponsorships. If you don't track any expenses, you'll be taxed on the full ₦5,000,000.

But what if you tracked these expenses?

- Video editing software (Final Cut Pro, Adobe Premiere): ₦150,000/year

- Freelance video editor: ₦1,200,000/year

- Camera and equipment: ₦800,000 (can be depreciated)

- Starlink equipment: ₦400,000

- Starlink monthly subscription: ₦50,000 × 12 = ₦600,000/year

- Mobile data for uploads: ₦30,000/month = ₦360,000/year

- Portion of electricity bill (home office): ₦200,000/year

- Accounting software or accountant fees: ₦100,000/year

That's ₦3,810,000 in legitimate business expenses. Now you're only taxed on ₦1,190,000 instead of ₦5,000,000.

At a 20% tax rate, that's ₦762,000 saved just by keeping receipts.

Expenses creators and remote workers should track

If you're a content creator:

- Editing software subscriptions (Adobe, Final Cut, DaVinci Resolve)

- Payments to editors, thumbnail designers, scriptwriters

- Camera, microphone, lighting equipment

- Studio rent or home office portion

- Music licensing fees

- Props and materials for videos

If you're a remote worker or freelancer:

- Internet costs (Starlink, fiber, mobile data)

- Laptop, monitor, keyboard, desk setup

- Software subscriptions (Figma, GitHub, Notion, Slack)

- Coworking space fees

- Professional development (courses, books, conferences)

- Travel for client meetings

If you run an online business:

- Hosting and domain costs

- Payment processing fees (Paystack, Flutterwave charges)

- Marketing and advertising spend

- Contractor and freelancer payments

- Software tools (analytics, email marketing, CRM)

The catch: you need proof

You can only deduct expenses you can prove. That means:

- Keep receipts: digital or physical, for every business purchase

- Separate accounts: use a dedicated bank account or card for business expenses

- Record consistently: log expenses as they happen, not at year-end

- Categorize properly: know which expenses are fully deductible vs. partially

The NRS can ask for documentation during an audit. If you can't prove an expense, you can't deduct it.

How Hagfish can help (and what's next with Hagfish Tax)

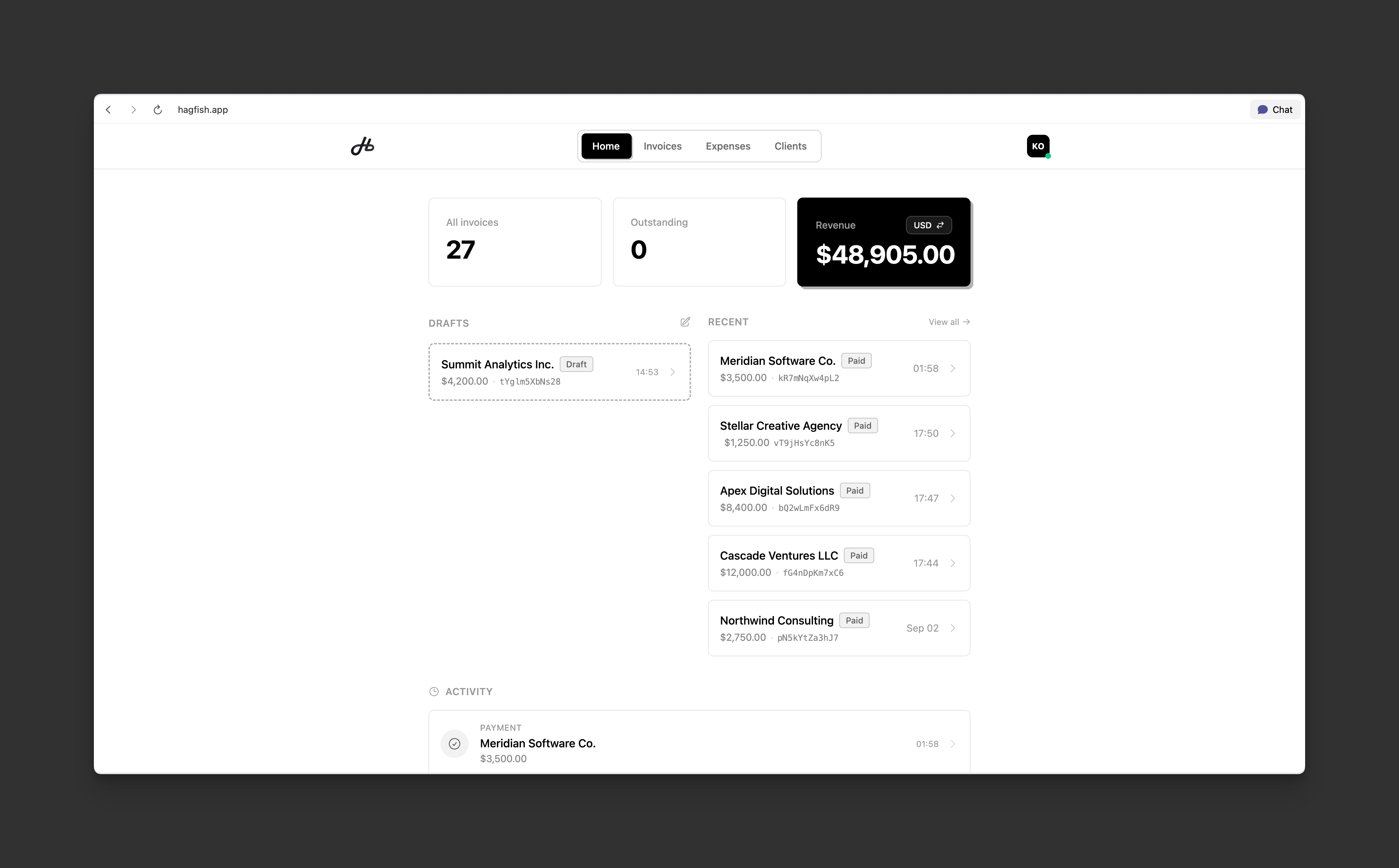

At Hagfish, our mission has always been to simplify work for creators and teams. With these new tax laws, here's how we can support you today, and what's coming next:

- Track expenses as they happen: Log business expenses, attach receipts, and categorize them for tax time. No more scrambling through bank statements in January.

- Generate tax-ready invoices: Every invoice includes proper TIN fields, VAT/WHT calculations, and the documentation you need for compliance.

- Store all your records in one place: Tax IDs, registration docs, invoice histories, and expense receipts, all organized and searchable.

- Export NTAA-ready reports: Pull reports formatted for NRS submission without extra formatting work.

- Coming Soon: Hagfish Tax, a dedicated tool we're building to automate tax compliance for creators and businesses. From filing support to integrations with the new NRS portals, it will help you stay focused on your work while handling the complexity in the background.

Final thoughts

The Nigeria Tax Act 2025 signals a new era of tax compliance: more centralized, more digital, and more tightly enforced. While that may feel intimidating, it also offers a chance to simplify and standardize compliance if you're prepared.

For creators and businesses, the key takeaway is this: get organized now. Keep clean records, know your obligations, and take advantage of tools that reduce the burden. With Hagfish (and soon, Hagfish Tax), staying compliant won’t get in the way of building and creating.